1. A leadership, as a strategy, needs to be differentiated.

After 17 years in financial services, a strange feeling is flowing through me: the majority of financial leaders are applying the same old-fashioned and conservative leadership. As if the finance sector was waterproof to new leadership styles used by successful companies like 3M, Twitter, Facebook, Apple or Google.

The increasing regulatory pressure often have been THE excuse justifying the lag of the financial industry. Compliance is obviously necessary and time-consuming. Nevertheless, if all the leaders are doing the same thing, how do you get an edge on your competitors ?

2. However, most of the time, financial leaders focus on economies of scale.

In the fundamental equation of a financial business, leaders have been focused on increasing the size of their company through Mergers & Acquisitions. Technology was expensive and needed an extended customer pool. Advisors “sold” potential synergies and financial leaders increased their power in the process.

This strategy brought us to a concentrated and poorly differentiated financial industry. For example, we know the difference between an iPhone and an old mobile. But are we able to formulate the difference between retail banks as Bank of America and Wells Fargo ?

There is nothing wrong with this strategy, it allows to cover IT costs,…

…except that it is forgetting customers and employees.

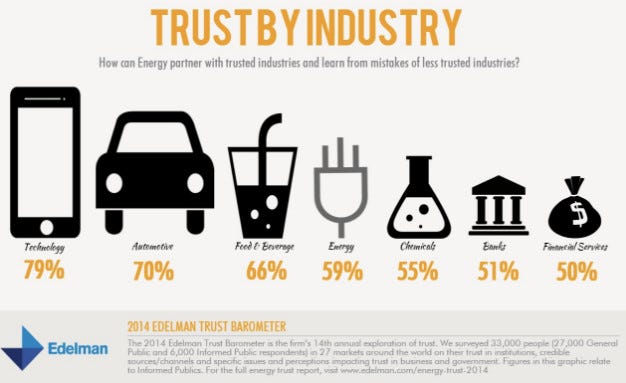

One proof of this statement is the low trust of the customers toward the incumbents players:

And IT costs are decreasing according to the Moore’s law. That’s the reason why fintech companies could get some traction and grab a significant part of the financial “cake”.

3. It is time to change ! By applying Corporate Social Responsibility, financial services could still reconnect with their stakeholders.

As we understand it easily, customers and employees are key to create a virtuous business dynamic:

When technology is “commoditized” and organizations are lean, the remaining lever of every service is the experience created at the point of contact between employees and customers. And when human is involved, 1+1=1 or 3. Why ? Because, emotions are contagious. Consequently, using positive emotions and the happiness advantage will benefit you and your company. You will have happiness for yourself and a higher productivity from your employees.

“In a financial industry desperately focused on financial goals or profits, a CSR strategy brings purpose.”

Meaning is one of the key ingredients to reach satisfaction or happiness, according to the father a positive psychology, Martin Seligman. And being environmentally conscious is a typical meaningful action: for example, when BNP Paribas decided to no longer finance coal mining, employees probably felt proud to be part of a “human” company.

Finally, an incredible amount of academic research confirm the importance of emotions management on productivity: Daniel Goleman, in his book “Emotional Intelligence”, talks about an optimal emotional state between boredom and excessive stress which maximizes performance. If you are still skeptical, Glassdoor, which gathered data about employees satisfaction, found a significatively higher stock performance among well-rated companies.

Nota bene: “Progress is impossible without change”. If you think this article have some value, feel free to like it ! Otherwise, I would be pleased if you could comment it and add some additional insights or ideas. Thanks.